Monday, December 17, 2012

President Obama's Address in Connecticut

In the midst of a horrific tragedy, we feel it is important to concentrate on the events that have happened in Connecticut. Here are the President"s remarks:

Saturday, December 15, 2012

The Future of Gun Control

Many will call the events in Connecticut a tragic accident,

or a horrible tragedy, but those descriptions are beating around the bush. This was a senseless massacre of innocent

life. What makes it even worse is the

fact that this is the 16th such mass shooting event in the United

States this year. Those

16 shootings have left 84 people dead.

The question is, how many more people must be brutally murdered before

legislators do anything?

| Shooting killed 26 people in Connecticut |

The time has come for some sanity on gun control. The facts show that more guns correlate with

more homicides (Harvard School of Public Health), just as the fact that states

that have tighter gun laws have fewer gun related deaths (Richard Florida). We as a country need to stop lying to

ourselves that guns make us safer and finally get some results in gun control

to ensure the safety of our population and ensure that such terrible killings

will not happen again.

Many would argue that the Constitution guarantees the right

to bear arms. However, the very same

document we uphold to be the law of the land and the reason why gun control

should not be enacted once contained provisions upholding the enslavement of

human beings, counting African Americans as three-fifths of a person, didn't allow women to vote, and didn't allow direct election of officials even after a

democratic revolution.

Moreover, when the founding fathers wrote that United States

citizens had a right to bear arms, they did not write a provision in the Bill

of Rights that upheld the right to carry concealed weapons, have firearms with

hundreds of rounds of ammunition, wear body armor, and shoot up a crowded

elementary school. The wide availability

to guns that people now have in this country creates an environment that

violates the basic tenant that our government is supposed to enforce: keep our

citizens safe.

We urge everyone to write to their representative and

Senator to spur action on this particular issue. We cannot afford to wait for the next tragedy for us to be influenced into action.

Friday, December 14, 2012

Simple Graphic Explaining Fiscal Cliff

USA Today put together an amazing graphic explaining the fiscal cliff. we encourage any curious minds to take a look:

Thursday, December 13, 2012

An Open Letter to Speaker John Boehner

Speaker Boehner,

As our nation rests on the perilous brink of insolvency, the

Government of the United States needs to raise taxes, somehow, on individuals and

companies, until the economy has achieved a strong growth rate for two

consecutive years.

The governmental debt of this great nation has ballooned to

around 70% of our Gross Domestic Product, far above what is considered healthy

for the economy. We need a way to lower

it. Doing so would enable us to ensure

the financial flexibility typical to a period of strong growth. Keynesian Deficit spending is an option, but

with an economy slowly rebounding, with unemployment now at 7.7%, we feel that

it is time to address the debt problem.

In order to do this effectively and responsibly, we must

employ a balanced approach. According to

the Congressional Budget Office, the well-regarded nonpartisan organization

that provides economic data to congress, only raising taxes or only cutting

spending could have drastic effects on the nation’s growth, crippling the

economy here in the United States and sending ripple effects across the world.

While cutting spending and increasing taxes would have some short term

detrimental effects, it pales in comparison to the alternative proposals.

Therefore, there is a need for increased revenue. The question remains: how do we get it? Here, we must also look for a balanced

approach. The government, when seeking

out ways to increase the amount of dollars going into the treasury, must look

for ways to spread the load of tax increases, making sure those earning very

little will not suffer any undue burden.

There are two ways to increase revenue-we can either raise

the base rate that people pay or we can eliminate tax deductions. A deduction is money that the government

gives back to taxpayers for reasons varying from making a charitable donation

to owning a private jet. Now obviously,

some deductions are more important than others.

By capping deductions, yet keeping the base rate the same, we can obtain

revenue for the government. In addition,

by changing the tax code by including revenue from stocks and dividends in this

new tax, which are now taxed lightly, for higher income earners will generate

much needed revenue for the government and will cut into the debt.

These tax increases, though levied on many Americans, would

not affect all people equally. Moreover,

since richer people tend to have more deductions and more income from the stock

market, the tax increase would be progressive.

This ensures equity and limits any economic damage that might occur. The money gained can be used for targeted

stimulus, or as we have been saying, to pay down the debt, ensuring a stable

future for the United States economy.

However, only capping deductions will not get us all the revenue we need. In order for this plan to be truly balanced, we also need the people who can afford it the most to pay slightly higher rates on income taxes. How much to change these is up in the air, but please ensure that tax increases are spread fairly on consumers and do not unduly burden the poor and the middle class.

We

should maintain there tax increases until necessary growth has occurred sustain a tax decrease. When we have strong growth, the base will be

large enough to finance a cut in taxes.

We need to get this debt problem under control. Spending cuts, as well as tax increases, must

be part of the plan to get this done.

Please communicate with the rest of your caucus that legitimate tax increases must be on the table. Deductions, as well as base rate increases may be necessary to cut the debt. Reforming the tax code, making it simpler and fairer can also help us in this problem. You can push the President on spending cuts all you want, but a stronger plan, on that includes revenue, is necessary to ensure our nation's economic stability for the future.

The Auxilia Party

Tuesday, December 11, 2012

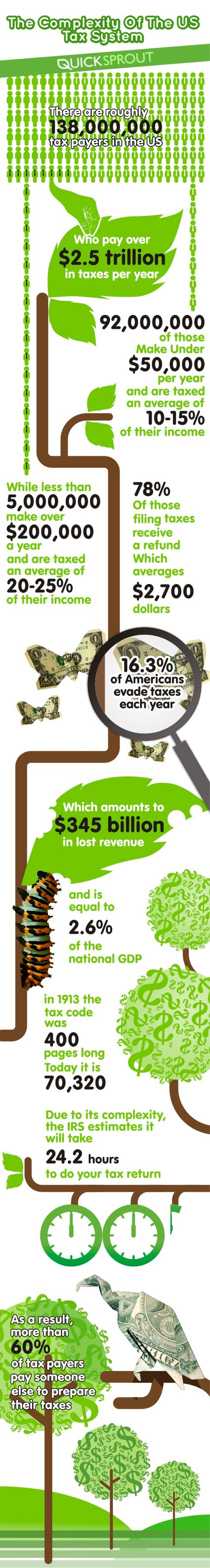

Adam Smith's Maxims of Taxation

In his book, The Wealth of Nations, economist Adam Smith, the father of capitalism, outlined four general principles, or maxims, that he thought ought to govern how governments levy, collect, and organize taxation in their countries. Each of these maxims is extremely applicable today, and if we can learn about and start following these principles, we have found a perfect place to start for tax reform in the United States.

The first of Adam Smith's maxims is equity. In Smith's view, since wealthy citizens benefit the most from government and are able to pay for it, the should shoulder a larger burden than others. "It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than that proportion." Equity, in other words, means that the wealthier a person is, the more of their income they will pay in taxes.

The second maxim is certainty. In Adam Smith's opinion, the taxes that a person owes should be certain and not arbitrary. The amount to be paid, when it should be paid, and the manner the tax should be paid in must all be clear. Without this, government officials could be tempted to abuse the tax system for their own personal gain.

Convenience is Adam Smith's third maxim. Taxpayers, he thought, should be relatively easy to figure out and the tax code must not be overly complicated. The process of paying taxes should be easy for citizens, as well as straightforward and predictable.

Adam Smith's fourth and final maxim is efficiency. Efficiency means that the cost of the whole tax collection system needs to be kept to a minimum, otherwise there is little point of collecting a tax that requires so many resources to collect. Taxation, Smith felt, should produce maximum gain for a government, while at the same time incurring minimal cost for the tax payers.

Clearly, the US government is not following these principles. More often now, people are turning to professional help to complete their tax returns, in part because they are so inconvenient to do.

Below is a graphic that Neil Patel from Quicksprout has put together, illustrating some problems with the tax code.

As you can see, the US government has a lot of work to do in tax reform. If we can fix some of the problems with complexity and inefficiency, we can increase revenue without having to increase rates. It's just one way we can help make this country more sustainable for the future.

Monday, December 10, 2012

Simpson Bowles on Taxes

Any plan that congress agrees on to avert the fiscal cliff must include some sort of tax reform. There is little way around it. The politicians tend to skirt the issue, we need to have a grown up conversation about how to improve our tax code. We can make it simpler, and we can make it fairer. There won't be any magical plans that promote 10% GDP growth and eliminate all debt by 2015. It's just not going to happen. What can happen though, is small steps in the right direction. The Simpson-Bowles plan makes such a step, pushing the dialogue forward on meaningful tax reform.

While the above chart might seem complicated, we've set out to describe, in simpler terms, the major elements of the Simpson-Bowles tax proposal.

First off, the Simpson-Bowles plan eliminates the Bush era tax cuts for the wealthiest Americans. This is done before changes are made to the tax code. The elimination of these breaks are built into its baseline.

Additionally, there are a lot of tax increases in the Simpson-Bowles plan. This is necessary to make any large scale dent in the debt. As a balanced approach, the revenue increases and spending cuts are roughly equal. The Simpson-Bowles plan also taxes dividends and capital gains as normal income. This basically results in a huge tax increase for the rich, who hold more of their wealth in stocks and would be taxed more in capital gains and dividends. Therefore, the Simpson-Bowles plan is able to lower the actual rate while still maintaining equity in taxation. The Simpson-Bowles plan also significantly cuts deductions for taxes, which allows it to lower some overall rates while still getting revenue increases. The difference is that people would be paying a higher percentage of their income, because they have less deductions from the baseline rate.

The Simpson-Bowles also recommends raising the gas tax by 15 cents. While this would undoubtedly hurt some Americans who need gas for travel, work, etc, It could be a much needed revenue booster and a way to get on the right track for green energy. Americans consume a lot of gasoline, so having a gas tax increase could dramatically increase the revenue into the government's coffers.

We'll have more on tax reform tomorrow.

Sunday, December 9, 2012

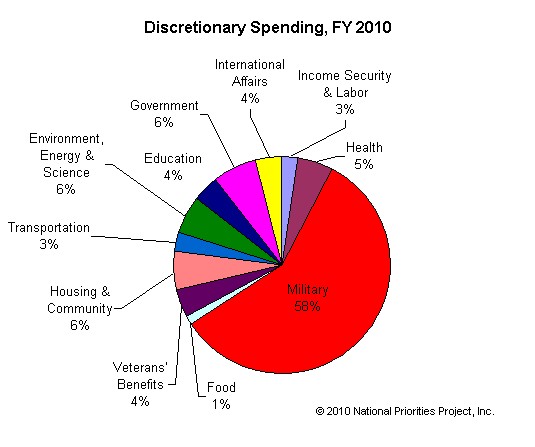

Simpson Bowles: Defense Cuts and Why We Need Them

The Simpson-Bowles plan, which we mentioned in yesterday's post, calls for deep cuts in defense spending, and for good reason. Defense spending makes up a significant portion of the nation's overall budget, and that share is even larger when we only look at discretionary spending. This makes the Department of Defense a prime candidate for budget cuts.

Military spending has also ballooned in recent years because of wars in Iraq and Afghanistan. Both these conflicts have increased the amount the United States spends on the military and each has had a significant effect of the debt of the nation. In the figure below, we can see the gradual increase in spending after September 11th, until Obama's military budget freeze.

Spending this much money just doesn't seem like a valid use of resources. The US military must learn to be more efficient with how it uses its money. Other countries all around the world, though they do not have the same military capabilities and presence of the United States, spend far less than us on defense. The United States is far and away the largest military spender in the world. It's time it took a step back and found more efficient ways to do things.

While military spending certainly helps US businesses grow and make profits, the amount the military spends is showing up less and less in actual changes to our GDP. Therefore, the value in trimming debt is going to be a far greater positive than the effect of any growth maintaining the spending levels might cause.

We can afford to make these defense cuts, and we will not be weaker as a nation because of them. While we might deploy less soldiers and fighter jets around the world, we can still be the most powerful military in the world. We spend so much, that cutting a bit probably won't make that much of a difference in the grand scheme of things. Also, a ballooning federal debt is also a national security risk, and endangers to solvency of our entire nation. It is in our country's best interests to find ways to reduce debt, and cutting unnecessary defense spending is one way to do that. As a part of a balanced approach, reforming the Pentagon budget is necessary in any negotiations regarding the fiscal cliff.

Saturday, December 8, 2012

The Fiscal Cliff: Part 3-Simpson Bowles

The Simpson-Bowles Plan is a plan for improving our nation's fiscal situation produced by the National Commission on Fiscal Responsibility and Reform, and named after the commission's co-chairs, former Republican U.S. Senator from Wyoming Alan Simpson and former Clinton Chief of Staff Erskine Bowles, a Democrat. This commission was created by president Obama in 2010 to identify policies that could be used to solve our budgetary crises.

The Simpson-Bowles Plan goes beyond what many other ideas to reduce deficits entail. Both Simpson and Bowles bravely recognize the need for increased revenue and reduced spending to get the nation back on the track of financial solvency. If we want to be serious about reducing our debt, there will be no easy decisions. Money must come from all places possible, and this includes reforms to the tax code, social security, and the defense budget.

As you can see in the figure above, the Simpson-Bowles proposal (Co-Chair Proposal) goes far beyond what any major party has come up with. What the plan might lack in depth in any one any it makes up for it in its balanced approach to cutting debt. Paul Ryan's plan includes more cuts to domestic discretionary spending, but leaves defense spending alone, for the most part. The Simpson-Bowles approach also increases revenue, partly by eliminating loopholes, partly by raising taxes. They understand that we cannot have a balanced approach without an increase in revenue. Until now, we have never fought a war without an accompanying tax increase to pay for it. Now, with wars in Afghanistan and Iraq, we have had two. This simply is not sustainable.

The Simpson-Bowles Plan goes beyond what many other ideas to reduce deficits entail. Both Simpson and Bowles bravely recognize the need for increased revenue and reduced spending to get the nation back on the track of financial solvency. If we want to be serious about reducing our debt, there will be no easy decisions. Money must come from all places possible, and this includes reforms to the tax code, social security, and the defense budget.

As you can see in the figure above, the Simpson-Bowles proposal (Co-Chair Proposal) goes far beyond what any major party has come up with. What the plan might lack in depth in any one any it makes up for it in its balanced approach to cutting debt. Paul Ryan's plan includes more cuts to domestic discretionary spending, but leaves defense spending alone, for the most part. The Simpson-Bowles approach also increases revenue, partly by eliminating loopholes, partly by raising taxes. They understand that we cannot have a balanced approach without an increase in revenue. Until now, we have never fought a war without an accompanying tax increase to pay for it. Now, with wars in Afghanistan and Iraq, we have had two. This simply is not sustainable.

We hope that Senators and Congressman, as well as the President, after initially spurning this plan, take a second look at it in the midst of fiscal cliff negotiations. We need real, concrete plans to cut debt if we are to ensure the financial stability of this nation for years to come. In coming posts, we will elaborate on details of the plan, and explain why its ideas are important.

Friday, December 7, 2012

The Supreme Court: DOMA and Proposition 8

The Supreme Court recently announced that they would review the Defense of Marriage Act (DOMA) and California's Proposition 8, a constitutional amendment that established marriage as between one man and one woman. The Defense of Marriage Act, passed in 1996 by large majorities in both houses of Congress, defined for federal purposes marriage as the legal union between one man and one woman. Under this act, no state is required to recognize any same-sex union performed in another state.

These two cases present a large opportunity for the Supreme Court to change the dynamic of LGBT equality around the country. Any decision the Supreme Court makes will likely have effects that reach far into the future.

The fact that the Supreme Court has even considered these cases means we have come a long way since initial days of extreme injustice.

Here is a PBS NewsHour report on the big news:

These two cases present a large opportunity for the Supreme Court to change the dynamic of LGBT equality around the country. Any decision the Supreme Court makes will likely have effects that reach far into the future.

Over recent years, the tide has turned regarding the public opinion on same-sex marriage. More and more people, polls have found, believe that same-sex couples should be allowed to marry.

Here is a PBS NewsHour report on the big news:

It will certainly be interesting to see how the conservative justices, namely Justice Kennedy and Chief Justice Roberts, react to this case.

Thursday, December 6, 2012

The Fed: Demystifying the Most Powerful Part of Government

As we discuss the debate over the fiscal cliff, it is important to understand what the government can do in order effect change on the economy. In this post, we'll concentrate on the Federal reserve, a very powerful, if not the most powerful, part of the US Government. The Federal reserve uses Monetary Policy, or the control of the money supply, in order to establish low unemployment and low inflation.

The Federal Open Market Committee is a group that does many actual transactions in order to regulate the money supply. This group is made up of all the national governors and 5 of the 12 regional heads. The chairman of the Federal reserve Bank of New York is always on this board, in recognition of New York City as the financial capital of the United States.

Now, the Federal Reserve has no power over fiscal policy, which is the manipulation of taxation and expenditure to promote low unemployment and low inflation. While the desired end result is the same, the power over Fiscal Policy resides mostly with Congress and the President. What the federal Reserve can do is adjust the amount of money in the economy to promote growth (easy money) or low inflation (tight money).

Now, while the Fed would like to be able to control interest rates to control monetary policy, in practice, most banks do not get their money from the Federal reserve. It is much easier to get money from fellow banks, and there is a strong stigma behind borrowing from the government. They can control rates indirectly, but by far the most commonly used tool or tools are Open Market Operations. Open Market Operations (OMOs) are activities by a central bank (the fed, in this case) to buy or sell government bonds on the open market. This helps control the supply of base money, the monetary base, or supply, of a nation's money.

As you can see above, in an easy money policy, more money is put into the economy, as the name would suggest. Here, the Fed spends money to buy bonds and securities held by citizens, providing them with money to increase the money supply. In tight money policy, the Fed sells these same bonds and securities, which people pay for with cash, taking that money out of the money supply. These operations are performed and adopted by the aptly named Federal Open Market committee (see above).

Now, even though the Fed has no power over taxing and spending, they can still regulate the money supply of the entire nation. This makes the Federal reserve and its head, Ben Bernanke, very powerful. they are charged with a great responsibility, and it is important that they get their job done right. Without guidance, the money supply could go up and up and up, leading to hyperinflation like that of Weimar Germany, where people used money, because it was cheaper than kindling and firewood.

It is important to understand how the Federal reserve works, especially since we discuss using fiscal policy (taxation and spending) to fix our nation's budget problems. We must coordinate our economic efforts, using both monetary and fiscal policy together, not against each other, to get our economy back on track.

Above is a graphic showing how the Federal reserve is set up. There are many organizations involved in the Federal Reserve, and the important thing to take away is that these organizations work together to establish monetary policy for the United States. The Board of Governors is the national level of the Federal Reserve. Ben Bernanke is the chairman of this board. There are also regional Federal Reserve Banks, which have headquarters in specific cities around the country, as you can see below.

Now, the Federal Reserve has no power over fiscal policy, which is the manipulation of taxation and expenditure to promote low unemployment and low inflation. While the desired end result is the same, the power over Fiscal Policy resides mostly with Congress and the President. What the federal Reserve can do is adjust the amount of money in the economy to promote growth (easy money) or low inflation (tight money).

For example, with an easy money policy, the Federal Reserve will allow the interest rates it charges to other banks to lower. This effectively lowers the cost of money. Money has a cost? one might ask. In a practical sense, it does. The cost of buying money in the form of a loan is the amount you pay in interest. By lowering interest rates, it is more attractive to buy money. Accordingly more people will get loans and more people will be spending that money, fueling the economy.

Tight Money Policy, on the other hand, raises interest rates, causing the price of money to rise and less people to borrow money. This seems like limiting the economy, and in effect, it is. In some cases, especially when there is high inflation, it becomes necessary to slow the economy down by making sure there is less money out in the economy. The Fed does this by employing a tight money policy.

As you can see above, in an easy money policy, more money is put into the economy, as the name would suggest. Here, the Fed spends money to buy bonds and securities held by citizens, providing them with money to increase the money supply. In tight money policy, the Fed sells these same bonds and securities, which people pay for with cash, taking that money out of the money supply. These operations are performed and adopted by the aptly named Federal Open Market committee (see above).

|

| Steelers QB: not the real Big Ben |

|

| Big Ben Bernanke |

It is important to understand how the Federal reserve works, especially since we discuss using fiscal policy (taxation and spending) to fix our nation's budget problems. We must coordinate our economic efforts, using both monetary and fiscal policy together, not against each other, to get our economy back on track.

Tuesday, December 4, 2012

Fiscal Cliff: Part 2-Taxes

If Congress does nothing to act on the expiration of the Bush Era tax cuts, many will see a modest rise in the amount of taxes they must pay. When planning for the future and trying to work a deal, Congress must balance cutting the deficit with economic recovery, as raising taxes would lead to a decrease in consumer spending, the principle part of Gross Domestic Product (GDP).

In the campaign this year, Mitt Romney championed limiting deductions as a way to make his proposed tax cuts revenue neutral. If applied to the fiscal cliff, we can use these same limits on deductions to increase the revenue that the government is able to collect. Capping total deductions at $50,000, according to the Tax Policy Center, would raise around $750 billion over a ten year period. Deductions would actually hurt the richest Americans the most, leaving middle class America unscathed. 80 percent of additional revenue would come from top earners in the 1%. Some deductions that are on the chopping block specifically appeal to rich Americans, as you can see in the table below of prospective plans. A tax break for corporate jets is such a deduction. Working with the deduction system could bring in even more money, though it would hurt more Americans in the process.

Another option is to increase personal income taxes to the pre-Bush tax cut levels. This would make a modest dent in the deficit, so more revenue is obviously needed.

All in all, we need a balanced approach on revenue increases just like we need a balanced approach on the whole fiscal cliff crisis. Congress needs to make sure that it is not unduly hurting anyone, especially the middle class and the poor. We're not out of the woods yet, with our economy in a sluggish recovery. Prudent fiscal policy is just what we need to continue or recovery and make a dent in our debt for the future.

Monday, December 3, 2012

The Fiscal Cliff Series: Part 1

The term "Fiscal Cliff" is used to describe the problem faced by Congress at present. A combination of tax cut expiration and automatic cuts will take effect come January 1st if a plan is not produced to avert the situation.

Because of Congress's failure to come to an agreement in accordance with the Budget Control Act of 2011, which raised the debt ceiling but left open the ways to cut deficit spending. Since a bargain was not reached, sequestration will occur, which mandates across the board spending cuts. In addition, the Bush era tax cuts will expire, as will a 2% Social Security Payroll tax cut, and the expiration of federal unemployment benefits.

If Congress doe snot act, as before, the results could be very grim for our country's growth. It will have a very detrimental effect on an economy that is still shaky.

|

| The effect of the Fiscal Cliff on GDP |

As you can see above, analysts have projected strong negative effects on our nation's GDP if we run over the Fiscal Cliff. The Tax Policy Center has stated that middle income families will pay, on average, $2,000 more dollars in taxes in 2013. The Congressional Budget Office (CBO) also anticipates increased unemployment where 3.4 million will lose their jobs.

That being said, the country cannot continue on the path it's on with regards to deficit spending. at least something needs to be done to curb our spending so that we get back on a sustainable debt track as our economy begins to rebound. Large deficit spending should really only be done it trying economic times, and we should try to steer clear of that now.

|

| The effect of the Fiscal Cliff on Deficit |

Sunday, December 2, 2012

A New Global Policy

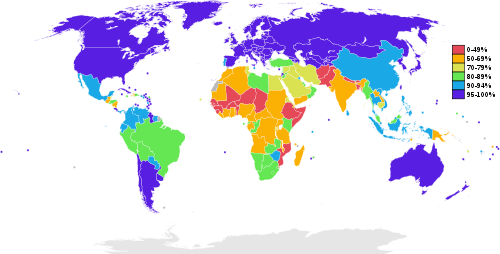

A major problem that we face when trying to bring about peace around the globe is education levels in developing and war torn countries. One way to measure this is by looking at the adult literacy rates, then comparing the rates to other countries.

|

| Literacy Rates by country |

The results we see are not promising. Countries in the Middle East have literacy rates significantly lower than those of developed and even developing nation, especially for women. This translates into fewer opportunities for members of those societies. Without strong educational institutions, the youth in Middle Eastern and North African Countries have few opportunities to advance themselves, leading to rampant unemployment.

So how does this affect our foreign policy?

In order to promote peace throughout the world, we must promote literacy and education. Young, educated people are forces of change throughout the world. By providing an education to lower class women, we can empower them more than ever before. Instead of using bombs, we ought to use books to create a new global policy. The Middle East has extreme poverty and although we may not think it is our problem, we need to make it our problem. It is much more effective to bring up a country through education than to use crash and burn tactics of military action.

The United States must work with other countries to promote more NGOs to work inside these countries to promote education reform. They must work with local governments to provide funding for schools. Additionally, we must open our own doors to these young people who wish to pursue a higher education within the United States. Politicians at home may not appreciate this policy, but it is much better in the long run to pursue a strategy of youth empowerment than to simply use military action. We need to pursue a foreign policy of inclusion if we are to bring about peace in the Middle East, not one of exclusion.

Saturday, December 1, 2012

Energy Reform Series: Part 4-The Economics of a Carbon Tax

Considering the rise fossil fuel emissions, especially those of carbon dioxide, something ought to be done in the form of policy change to promote reduction of pollution. In this post, we will look at one idea, a carbon tax, which would be imposed on industry to promote reduction in fossil fuel use.

Taxes would be levied on carbon use. Energies such as coal or gasoline would have a much higher rate than solar or wind power. These clean sources of power would likely not be taxed at all. Firms have a strong incentive to adopt whatever new technology is necessary to reduce their carbon footprint.

The draw of a carbon tax over Cap and Trade is its simplicity. Cap and Trade involves the buying and selling of carbon credits with other companies. The Carbon Tax simply levels a tax on carbon use on all companies. This would also mean a carbon tax could be implemented much more quickly than a cap and trade system. From a government's perspective, the carbon tax could be more beneficial, as it supplies additional revenue to their coffers.

However, this could also mean higher energy prices for consumers. The government might have more money, but one way to get around tax for energy companies would be to simply raise rates. This could be a very negative effect of trying to fix a very important problem.

One way to solve this problem is to change the way the money is allocated once it is collected from the polluters. Since households would be paying more, it makes sense to alleviate them of a burden that was supposed to be placed on major polluters.

To do this, the government would use the money collected to pay out benefits or provide tax breaks to households that would bear a burden from paying the higher rates. This makes the whole system revenue neutral. This would be preferable over simply levying a tax. This way, consumers can actually make a profit by implementing their own energy saving measures, instead of just holding steady or paying their original bill.

Whether it's the Carbon Tax or Cap and Trade, Congress must act soon on establishing some method of reducing our fossil fuel consumption. Profit is a huge incentive for businesses, and anything that cuts into that profit is an unwelcome burden on businesses. We need to use financial incentives for our advantage when it comes to energy policy. Both Cap And Trade and the Carbon Tax do this: they make it worth a business's while to invest in ways to reduce consumption and increase efficiency. If we do this, we can make sure that our commercial and industrial sector of the economy is clean and efficient, paving the way for energy independence.

Taxes would be levied on carbon use. Energies such as coal or gasoline would have a much higher rate than solar or wind power. These clean sources of power would likely not be taxed at all. Firms have a strong incentive to adopt whatever new technology is necessary to reduce their carbon footprint.

The draw of a carbon tax over Cap and Trade is its simplicity. Cap and Trade involves the buying and selling of carbon credits with other companies. The Carbon Tax simply levels a tax on carbon use on all companies. This would also mean a carbon tax could be implemented much more quickly than a cap and trade system. From a government's perspective, the carbon tax could be more beneficial, as it supplies additional revenue to their coffers.

However, this could also mean higher energy prices for consumers. The government might have more money, but one way to get around tax for energy companies would be to simply raise rates. This could be a very negative effect of trying to fix a very important problem.

One way to solve this problem is to change the way the money is allocated once it is collected from the polluters. Since households would be paying more, it makes sense to alleviate them of a burden that was supposed to be placed on major polluters.

To do this, the government would use the money collected to pay out benefits or provide tax breaks to households that would bear a burden from paying the higher rates. This makes the whole system revenue neutral. This would be preferable over simply levying a tax. This way, consumers can actually make a profit by implementing their own energy saving measures, instead of just holding steady or paying their original bill.

Whether it's the Carbon Tax or Cap and Trade, Congress must act soon on establishing some method of reducing our fossil fuel consumption. Profit is a huge incentive for businesses, and anything that cuts into that profit is an unwelcome burden on businesses. We need to use financial incentives for our advantage when it comes to energy policy. Both Cap And Trade and the Carbon Tax do this: they make it worth a business's while to invest in ways to reduce consumption and increase efficiency. If we do this, we can make sure that our commercial and industrial sector of the economy is clean and efficient, paving the way for energy independence.

Subscribe to:

Posts (Atom)

.jpg)