In his book, The Wealth of Nations, economist Adam Smith, the father of capitalism, outlined four general principles, or maxims, that he thought ought to govern how governments levy, collect, and organize taxation in their countries. Each of these maxims is extremely applicable today, and if we can learn about and start following these principles, we have found a perfect place to start for tax reform in the United States.

The first of Adam Smith's maxims is equity. In Smith's view, since wealthy citizens benefit the most from government and are able to pay for it, the should shoulder a larger burden than others. "It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than that proportion." Equity, in other words, means that the wealthier a person is, the more of their income they will pay in taxes.

The second maxim is certainty. In Adam Smith's opinion, the taxes that a person owes should be certain and not arbitrary. The amount to be paid, when it should be paid, and the manner the tax should be paid in must all be clear. Without this, government officials could be tempted to abuse the tax system for their own personal gain.

Convenience is Adam Smith's third maxim. Taxpayers, he thought, should be relatively easy to figure out and the tax code must not be overly complicated. The process of paying taxes should be easy for citizens, as well as straightforward and predictable.

Adam Smith's fourth and final maxim is efficiency. Efficiency means that the cost of the whole tax collection system needs to be kept to a minimum, otherwise there is little point of collecting a tax that requires so many resources to collect. Taxation, Smith felt, should produce maximum gain for a government, while at the same time incurring minimal cost for the tax payers.

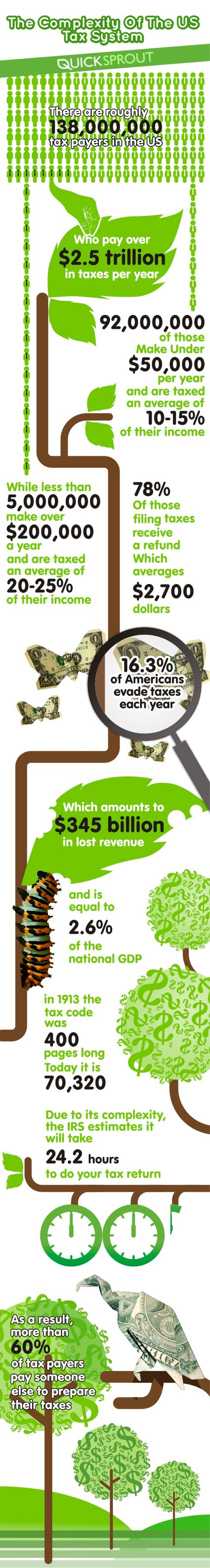

Clearly, the US government is not following these principles. More often now, people are turning to professional help to complete their tax returns, in part because they are so inconvenient to do.

Below is a graphic that Neil Patel from Quicksprout has put together, illustrating some problems with the tax code.

As you can see, the US government has a lot of work to do in tax reform. If we can fix some of the problems with complexity and inefficiency, we can increase revenue without having to increase rates. It's just one way we can help make this country more sustainable for the future.